Established in 2006, ColCap is a leading privately owned non-bank lender in Australia.

We offer Australian residential mortgage loans to prime borrowers through wholesale, retail, and broker distribution channels under the Origin Mortgage Management Services, Homestar Finance, Granite Home Loans, Austrata Finance and prime Buy To Let (BTL) mortgages through its subsidiary, Molo Finance in the UK.

The ColCap Financial Group

Innovative, growth-focused business that creates opportunities for business partners and customers.

Origin Mortgage

Management Services

Origin Mortgage Management Services (Origin MMS) is a longstanding wholesale mortgage distribution business. As an established and reputable lender, our core business is providing third-party funding and white-label mortgage management support.

Origin MMS also provides account servicing, back-office loan processing and underwriting support.

Origin Mortgage Management Services is a business division of Columbus Capital Pty Ltd,

ABN 51 119 531 252 AFSL and ACL: 337303

Granite Home Loans

Established in 2018, Granite Home Loans is for brokers. By providing innovative SMSF, NDIS and Lender Paid LMI products, through our partnerships we offer innovative home loan solutions at competitive rates.

Granite delivers across each step of the home loan journey, providing personalised

services, tailored products, and support to ensure every loan is handled with expert care from enquiry to settlement.

Granite Home Loans Pty Ltd, ABN 27 622 955 524 ACL: 516104

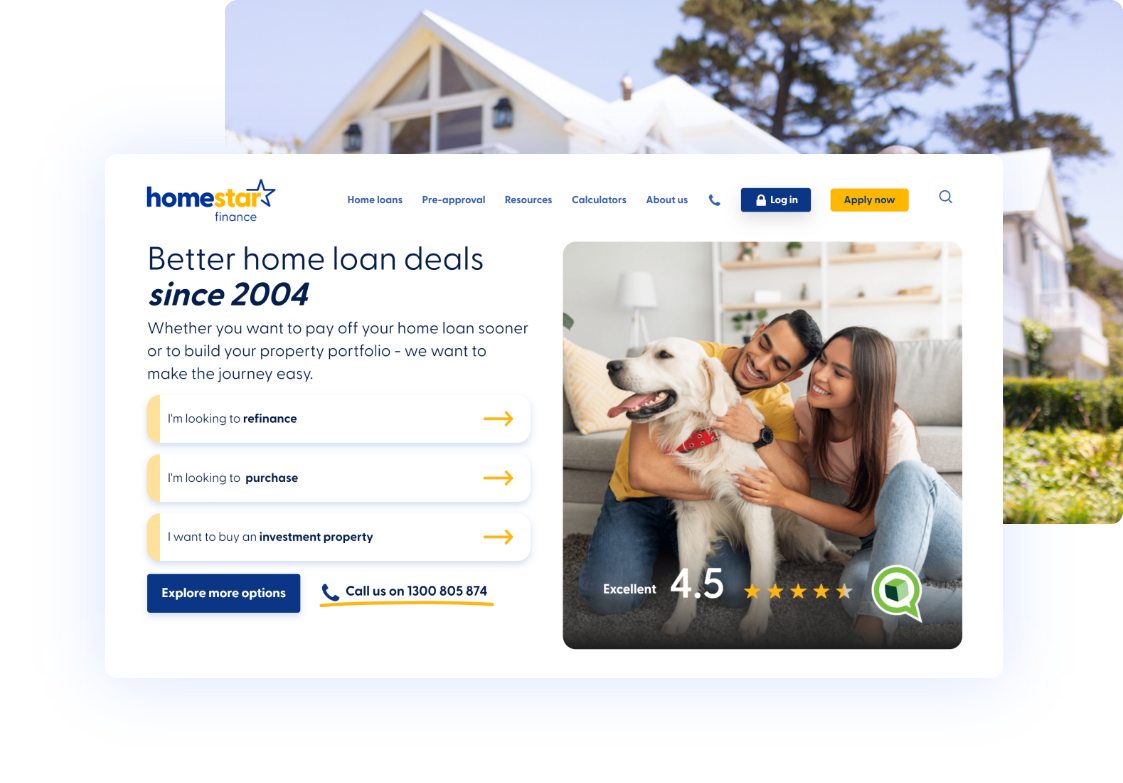

Homestar Finance

Homestar Finance has been providing Australians with competitive and customer focused home loan solutions since 2004.

As an online mortgage lender, our dedicated team of loan specialists take the time to find the right home loan, tailored for our customers’ needs. Great rates. Great service. This is where customers feel at home.

Homestar Finance Pty Ltd (ACN: 109 413 498, AFSL and ACL 390 860) is a wholly owned subsidiary of Columbus Capital Pty Ltd, ABN 51 119 531 252 AFSL and ACL: 337303

Molo Finance

Molo Finance is a digitally-focused lender in the United Kingdom that is reinventing the once tedious and inefficient mortgage lending process by converting it into a quick and transparent digital application, easily usable by mortgage seekers of any level of experience.

Since 2022, when ColCap formed a strategic partnership with Molo, ColCap has continued to invest in Molo and eventually acquired it entirely in 2024. ColCap is supporting Molo’s expansion and strengthening its position as a leader in the UK buy-to-let mortgage market.

ColCap Financial UK Limited Company Number 14127877

Austrata Finance

Austrata Finance provides tailored funding solutions for Owner Corporations, allowing strata schemes to complete essential projects without tapping into sinking funds or imposing hefty levies. Austrata Finance provides choices to each owner on the funding solution that best suits their needs. We empower property owners and strata schemes to take action now, ensuring property developments move forward seamlessly.

Austrata Finance is part of the ColCap Financial Group.

ABN 88 646 360 796 | Australian Credit Licence No. 528856

Our core values

Bringing innovative solutions to our community

Care for our people

Own what we do

Lead by example

Curious

& Innovative

Act with integrity

& respect

Put the customer

first

What we do

We believe in the potential of our customers and their ability to create value for themselves, their families, their businesses and their communities.

We empower them by not only generating opportunities through innovative product offerings, funding structures, and outsourced servicing infrastructures – we also provide our own services to help you thrive in the modern market.

Funded through a combination of warehouse facilities and term capital market transactions.

Diversity of product offerings – working closely with our partners to tailor branded and white label products.

A comprehensive mortgage product suite catering for owner occupied, investor loans, construction and self managed super fund borrowers.

Australia-wide distribution through mortgage managers, direct and mortgage brokers.

Processing tens of thousands of transactions per month.

Residential mortgage-focused loan portfolio in excess of $17 billion.

A timeline of our story

October

Establishment of Columbus Capital Pty Ltd

January

Settled the first home loan

June

Acquired $235m mortgage portfolio from Bluestone

October

Residential Mortgage-Backed Security, Nautilus 2007-1 (first RMBS)

September

Acquired Origin Mortgage Management Services, $2.3bn loan portfolio from ANZ Bank

November

Set up business process outsourcing service in Manila

March

Residential Mortgage-Backed Security, Triton 2013-1 (first prime RMBS)

August

Set up an office in Manila with approx. 60 FTE

November

Acquisition of Homestar Finance

September

Residential Mortgage-Backed Security, Vermillion 2019-1 (first non-resident RMBS)

July

Residential Mortgage-Backed Security, Triton SMSF 2020-1 (first SMSF RMBS)

February

Residential Mortgage-Backed Security, Triton 2021-1 (largest RMBS acquisition)

November

Acquisition of Granite Home Loans

September

Reached $12bn funds under management

February

Residential Mortgage-Backed Security, Triton 2024-1 (AAA tranche and Green tranche)

July

Molo is a wholly owned subsidiary of ColCap

Exceeds $15bn funds under management

October

Establishment of Columbus Capital Pty Ltd

January

Settled the first home loan

June

Acquired $235m mortgage portfolio from Bluestone

October

Residential Mortgage-Backed Security, Nautilus 2007-1 (first RMBS)

September

Acquired Origin Mortgage Management Services, $2.3bn loan portfolio from ANZ Bank

November

Set up business process outsourcing service in Manila

March

Residential Mortgage-Backed Security, Triton 2013-1 (first prime RMBS)

August

Set up an office in Manila with approx. 60 FTE

November

Acquisition of Homestar Finance

September

Residential Mortgage-Backed Security, Vermillion 2019-1 (first non-resident RMBS)

July

Residential Mortgage-Backed Security, Triton SMSF 2020-1 (first SMSF RMBS)

February

Residential Mortgage-Backed Security, Triton 2021-1 (largest RMBS acquisition)

November

Acquisition of Granite Home Loans

September

Reached $12bn funds under management

February

Residential Mortgage-Backed Security, Triton 2024-1 (AAA tranche and Green tranche)

July

Molo is a wholly owned subsidiary of ColCap

Exceeds $15bn funds under management

Did you know?

Origin Mortgage Management Services is one of the oldest non-bank lenders in Australia.